Reasons to Offer Long Term Care Insurance in Your Product Portfolio

It's Profitable.

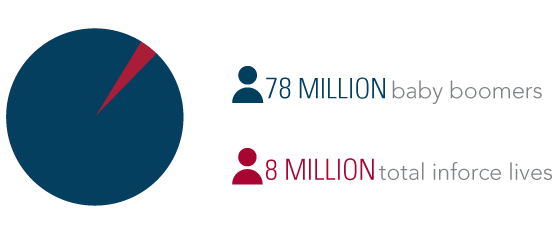

At this time, 78 million baby boomers are approaching retirement* – a group close to a quarter of the estimated U.S. population – and they are currently considering the looming act of having to pay for long term healthcare costs. Simultaneously, insurance carriers across the industry have increased premiums by an average of 250% higher than they were between ten and fifteen years ago - an effort meant to counter the costs of the poor legacy underwriting made during those years. This largely untapped market combined with high-priced products creates an opportunity for significant earning potential.

The Industry is Stabilizing.

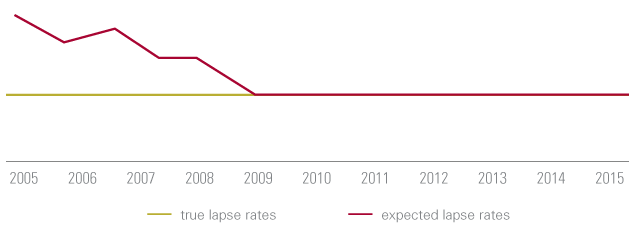

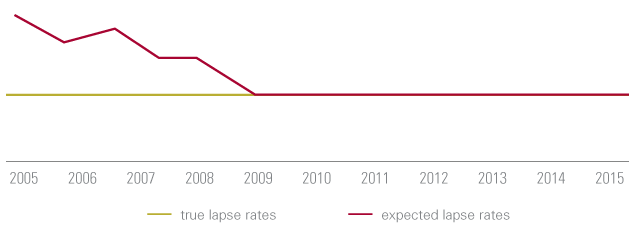

During the early 2000s, underwriters throughout the Long Term Care industry wrote policies based on relaxed rules while also underestimating policyholders' morbidity. Consequently, premiums were priced too low and carriers struggled to cover policyholder expenses as they lived longer and claims began to increase in number. While LifeCare's strict underwriting practices – protocols required since its inception – buffered it from the impact of higher claim costs, the rest of the industry was not as prepared. In response, carriers have greatly increased the price of their premiums (to deflect their losses) and have initiated far tighter underwriting procedures (to prevent a recurrence). While the industry continues to manage the residual effects of poor legacy underwritings, it is witnessing consolidation slowing and the rise in prices leveling off. Companies who enter the industry now will have the benefit of better underwriting and adequate premium rates.

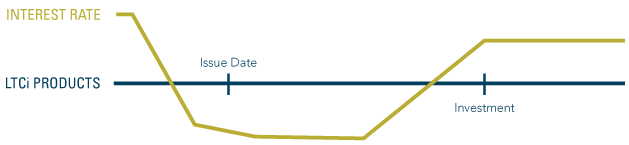

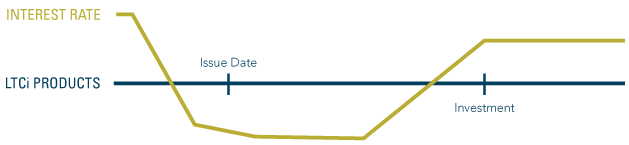

The Truth about the Interest Rate Environment.

Long Term Care insurance products are not impacted by current interest rates because low lapse rates and strong underwriting means most investment occurs years after issue. LTCi products are buffered by the extended duration of time before claims become due.

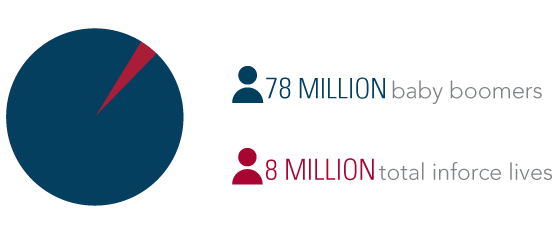

Market Share Opportunity is Greater than it has been in Decades.

The Long Term Care industry has gone through a state of consolidation, leaving fewer carriers in the market and less competition. This business environment has generated a substantial growth opportunity for companies entering the market.

You Differentiate Yourselves by Offering Something No One Else Does.

Your agents want a new product to sell – particularly one with highly sought-after benefits offered by no other company. By expanding your product portfolio to include an exclusive, valued product your agents can use to differentiate themselves, you gain stronger agent loyalty and retain top talent. In addition, the new agents you attract to your distribution network will inadvertently be introduced to the rest of your products, leveraging the long term care insurance sales process as an additional opportunity.

Offer a Truly Comprehensive Retirement Portfolio

Without a long term care health plan, a retirement plan is not comprehensive and leaves customers with the prospect of losing their retirement capital to expensive and wide-ranging medical costs when they suffer a chronic or disabling condition. By providing long term care coverage, you protect your customers with a savings and investment portfolio that preserves their wealth across all areas.